Everything Starts with Finance ORIX Evolvrd by Creating Businesses

Have a Nice Flight!

~Putting Leasing Work in Air Travel~

-

Making Air Travel Much More Accessible

Low Cost Carriers (LCCs) have taken the air travel market by storm with unbelievably low fares. For example, there is now a one-way fare of 5,990 yen from Tokyo to Sapporo, and a one way fare of 7,980 yen from Osaka to Taiwan. The major airlines have also taken steps such as expanding their route networks with new destinations. In these and other ways, the airline industry has been making its fair share of headlines in recent times.

For the traveling public and businesspeople, discount airfares and new routes are certainly something to cheer about.

These developments have been made possible, in large part, by aircraft leasing. -

Do Aircraft Really Belong to the Airlines?

It is commonly believed that airlines own all of their aircraft.

However, an aircraft is an asset worth several billion to tens of billions of yen or more. It is not an easy matter for the airlines to purchase aircraft, even if they wish to increase flights or change the size of their aircraft.

Leasing provides the airlines with an alternative. Because a leasing company purchases an aircraft and leases it to an airline, the airline need not raise lots of money at once to buy the aircraft. And because the airline can use the aircraft only as long as it is needed, leasing gives airlines the flexibility needed to respond nimbly to changes in the operating environment.

Some observers predict that leased aircraft might account for about half of all commercial aircraft in service globally by the year 2020. Clearly, leasing has become essential to the airline industry. -

More than Thirty Years in the Aircraft Leasing Industry

ORIX can actually trace the beginnings of its aircraft leasing business back to 1978, when aircraft finance leases started to gain ground. However, it was not all smooth sailing in the years after we entered the business.

Around 25 years ago, ORIX finalized a large leasing negotiation and placed an order for more than 20 new aircraft with an aircraft manufacturer. Just as we placed the order, the First Gulf War broke out in the Middle East, sending the aircraft market off a cliff. In response, we had to scramble to find a new lessee for each aircraft. Even after we had managed to find a lessee through exhaustive searching, we then discovered that the lessees had gone bankrupt after signing the lease agreement. We then had to rush out to recover the aircraft. And we continued working hard to find the next lessee, with our team members at the time traveling the entire world to find leasing customers for the aircraft. -

Establishing a Specialized Aircraft Leasing Company in Ireland

To ride out these sorts of crises, we established a specialized aircraft leasing company in Dublin, Ireland, in 1991, a year after the outbreak of the First Gulf War.

We selected Ireland because it is the birthplace of aircraft leasing. With this background, Ireland attracts some of the world’s leading aircraft professionals.

Faced with adversity, we persevered with the aircraft leasing business without giving up, even as some of our peer companies withdrew from the business. Besides finding aircraft lessees, we amassed credit screening capabilities and a broad range of expertise, including specialized technical aircraft knowledge. This gave us the ability to not just lease new aircraft, but also to conduct tasks that truly put our expertise to the test, such as leasing used aircraft and selling aircraft components.

From this, we can see that the ORIX DNA of seeking to create new value has firmly taken root in the aircraft leasing business. -

Putting Finance to Work in Air Travel

Currently, Japan’s major airlines are estimated to operate a commercial fleet of approximately 200 aircraft. ORIX has a fleet of approximately 150 aircraft under ownership and management. We lease these aircraft to airlines around the world.

According to the market projections of U.S.-based Boeing, the number of commercial aircraft currently in service is forecast to roughly double in 20 years.

We will continue putting finance to work in air travel for many more years to come.

Read Other Case Studies

-

ORIX

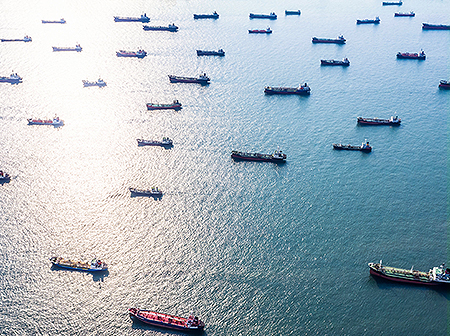

Supporting the Marine Transportation Business of Japan, a Major Importer of Resources

-

ORIX Real Estate

Bon Appetit!

-

ORIX Auto

Is This a Hotel Lobby?

-

ORIX

Can Power Be Generated From an Airport?

-

ORIX Environmental Resources Management

A Waste Processing Facility That Produces Resources

-

ORIX Rentec

We Offer Technology for Rent Too

-

ORIX Real Estate

Tea at the Aquarium